|

Blog on Stocks for March 5, 2024.

These stocks appeared on one of our screening reports approximately 10 trading days ago and are further

limited to ones that have some Stock-Options (Calls and Puts) with decent trading volume.

We provide these for education purposes only and not making a recommendation... especially on a delayed report.

We are just helping you see what you can do in a few short minutes per day.

Blog Index

|

AMEAMETEK

AME is part of the Specialty Industrial Machinery sector. Not so long ago AME gave us a reason to review the charts because it has gained strength. The stock closed back then at $173.41. Referring to the chart here, the last price is $179.12 meaning the stock went up $5.71 per share. That looks like a 3.3% increase. To see more information click here: Todays chart for AME.

The chart on the right shows what we saw 14 trading days ago. The green arrows on the chart mark the point that we took interest. |

|

COINCOINBASE GLOBAL INC. CLASS A

COIN is categorized in the Financial Data & Stock Exchanges sector. At the end of the trading day 14 days ago COIN caught our attention since it jumped in value recently. The stock closed for that day at $160.38. Referring to the chart here, the last price is $217.45 meaning the stock went up $57.07 per share. This banks in at a 35.6% increase. To see more information click here: Todays chart for COIN.

The chart on the right shows what we saw 14 trading days ago. The green arrows on the chart mark the point that we took interest. |

|

CRHCRH

CRH stands in the Building Materials sector. At the end of the trading day 14 days ago CRH became attention worthy because it has gained strength. The stock ended trading at $74.75. The last closing price on this chart is $81.84 meaning the stock went up $7.09 per share. That equates to a 9.5% increase. To see more information click here: Todays chart for CRH.

The chart on the right shows what we saw 14 trading days ago. The green arrows on the chart mark the point that we took interest. |

|

CVNACARVANA CO

CVNA is in the Auto & Truck Dealerships sector. At the end of the trading day 8 days ago CVNA popped up on our screen because it has moved up sharply in recent days. The stock closed on that day at $69.23. Looking at this chart we see the final price is $77.54 meaning the stock had risen by $8.31 per share. That looks like a 12.0% increase. To see more information click here: Todays chart for CVNA.

The chart on the right shows what we saw 8 trading days ago. The green arrows on the chart mark the point that we took interest. |

|

DELLDELL TECHNOLOGIES INC

DELL is categorized under the Computer Hardware sector. It was 8 days ago that DELL caused us to review the chart because the price increase was exceeding the expected pace. The stock closed on that day at $90.35. Referring to the chart here, the last price is $116.46 meaning the stock increased by $26.11 per share. This works out to a 28.9% increase. To see more information click here: Todays chart for DELL.

The chart on the right shows what we saw 8 trading days ago. The green arrows on the chart mark the point that we took interest. |

|

FNDFLOOR & DECOR HOLDINGS INC

FND is related to the Home Improvement Retail sector. Just 8 days ago FND was listed in our Strong Trend report because it has moved up sharply in recent days. The stock ended trading at $117.11. At the time of this blog, the attached chart show a last price of $120.69 meaning the stock went up $3.58 per share. It computes to a 3.1% increase. To see more information click here: Todays chart for FND.

The chart on the right shows what we saw 8 trading days ago. The green arrows on the chart mark the point that we took interest. |

|

HOODROBINHOOD MARKETS INC

HOOD is linked with the Capital Markets sector. At the end of the trading day 14 days ago HOOD grabbed 10 seconds of our time since it jumped in value recently. The stock finished trading at $13.38. The last closing price on this chart is $15.81 meaning the stock gained $2.43 per share. That looks like a 18.2% increase. To see more information click here: Todays chart for HOOD.

The chart on the right shows what we saw 14 trading days ago. The green arrows on the chart mark the point that we took interest. |

|

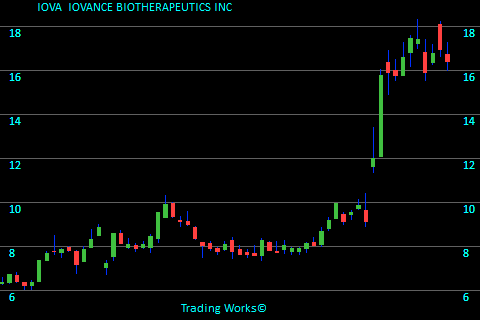

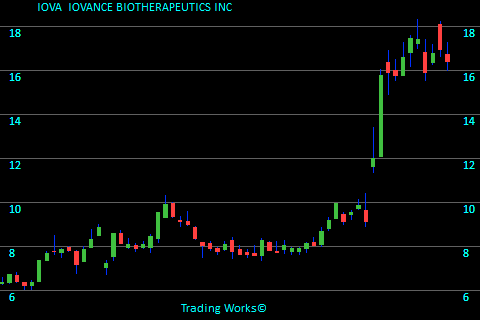

IOVAIOVANCE BIOTHERAPEUTICS INC

IOVA is linked with the Biotechnology sector. At the end of the trading day 11 days ago IOVA popped up on our screen because it has gained strength. The stock closed for that day at $12.03. Referring to the chart here, the last price is $16.40 meaning the stock advanced by $4.37 per share. This banks in at a 36.3% increase. To see more information click here: Todays chart for IOVA.

The chart on the right shows what we saw 11 trading days ago. The green arrows on the chart mark the point that we took interest. |

|

JPMJPMORGAN CHASE

JPM belongs to the Banks - Diversified sector. At the end of the trading day 11 days ago JPM grabbed 10 seconds of our time because it has moved up sharply in recent days. The stock ended trading at $179.73. The last closing price on this chart is $188.12 meaning the stock increased by $8.39 per share. That equates to a 4.7% increase. To see more information click here: Todays chart for JPM.

The chart on the right shows what we saw 11 trading days ago. The green arrows on the chart mark the point that we took interest. |

|

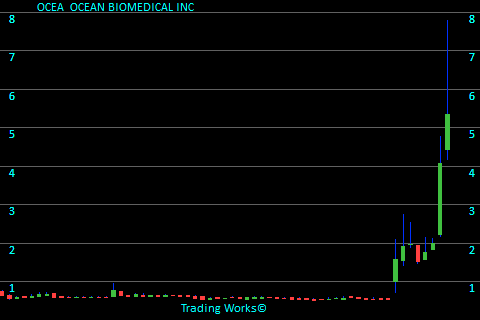

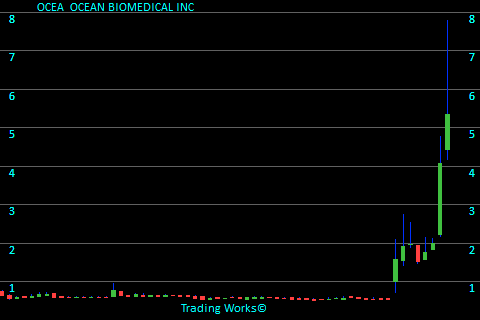

OCEAOCEAN BIOMEDICAL INC

OCEA is grouped in the Biotechnology sector. Recently OCEA became attention worthy since it jumped in value recently. The stock closed for that day at $1.57. For this chart, the closing price is $5.33 meaning the stock went up $3.76 per share. It computes to a 239.5% increase. To see more information click here: Todays chart for OCEA.

The chart on the right shows what we saw 8 trading days ago. The green arrows on the chart mark the point that we took interest. |

|

RBARB GLOBAL INC

RBA is part of the Specialty Business Services sector. Only a few days ago RBA caught our attention There is no guarantee that it will rise, but it's certainly worth watching. To see more information click here: Todays chart for RBA.

The chart on the right shows what we saw 8 trading days ago. The green arrows on the chart mark the point that we took interest. |

|

VTYXVENTYX BIOSCIENCES INC. COMMON STOCK

VTYX is linked with the Biotechnology sector. Recently (11 days ago) VTYX gave us a reason to review the charts due to the fact it had a good improvement in its price. The stock ended trading at $2.99. For this chart, the closing price is $8.48 meaning the stock increased by $5.49 per share. That equates to a 183.6% increase. To see more information click here: Todays chart for VTYX.

The chart on the right shows what we saw 11 trading days ago. The green arrows on the chart mark the point that we took interest. |

|

XLIINDUSTRIAL SELECT SECTOR SPDR

At the end of the trading day 14 days ago XLI caused us to review the chart because it looks like an emerging opportunity. The stock closed for that day at $117.86. The last closing price on this chart is $120.78 meaning the stock moved up $2.92 per share. This banks in at a 2.5% increase. To see more information click here: Todays chart for XLI.

The chart on the right shows what we saw 14 trading days ago. The green arrows on the chart mark the point that we took interest. |

|

XRTSPDR S&P RETAIL

Recently XRT popped up on our screen because it has gained strength. The stock closed back then at $74.63. For this chart, the closing price is $76.69 meaning the stock advanced by $2.06 per share. This works out to a 2.8% increase. To see more information click here: Todays chart for XRT.

The chart on the right shows what we saw 8 trading days ago. The green arrows on the chart mark the point that we took interest. |

|

Trading stats for this day:

Total Value of stocks tracked is $88.7 Trillion.

Total Value recently traded was $549 Billion.

Total Value of Options traded (in our zone) was $932 Million.

2,395,213 Call volume.

2,061,699 Put volume.

Blog Index

© publishing since 2005.

© publishing since 2005.

© publishing since 2005.

© publishing since 2005.